Trading strategies

All strategies are FREE on the NanoTrader Full platform.

Five strategies are available FREE of charge in NanoTrader Free.

Many of the strategies are used by famous traders.

You can set up your own strategies without programming.

All strategies can be traded manually or (semi-)automatically.

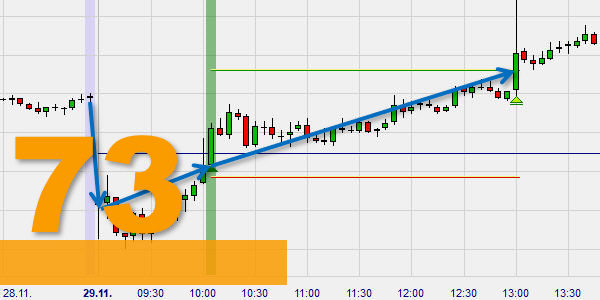

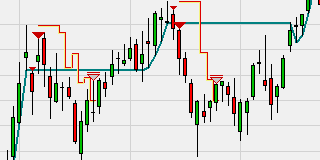

The London Reversal System

Trade the transition between the Asian, London, and US sessions.

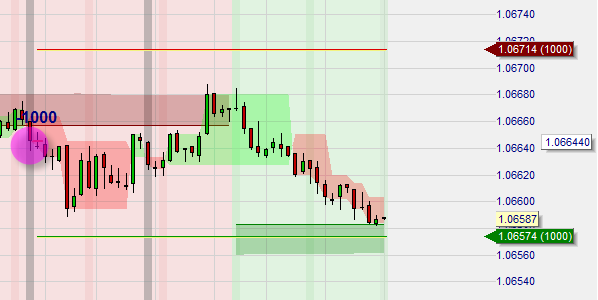

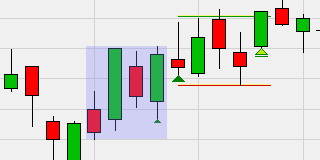

The Fair Value Gap strategy

The RSS strategy

The Daily Range Reversal strategy

The ATR (No)Trend strategy

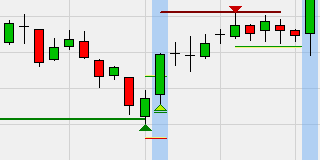

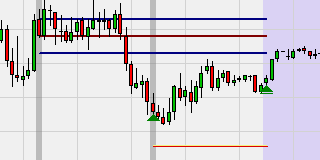

The Key Points strategy

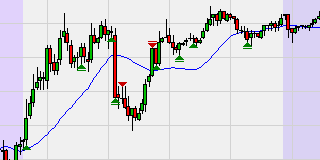

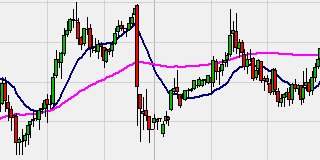

The Two EMA Cross day trading strategy

The DAX-ORB trading strategy

The Global Forex trading strategy

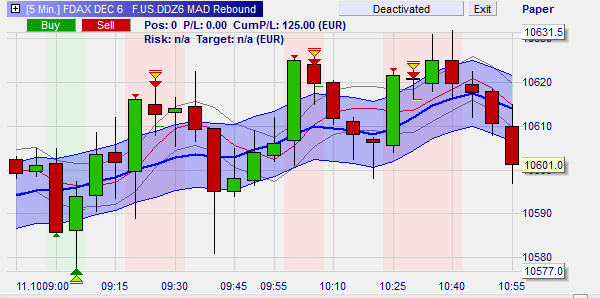

The Expo Bounce day trading strategy

A user-friendly day trading strategy specialising in bounce backs.

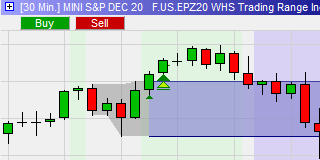

The Histo Breakout trading strategy

A breakout strategy, which generates signals when the price is in a range and volatility is low.

The R3 trading strategy

The ATR Channel Breakout strategy

A simple trading strategy from one of the famous Turtle Traders

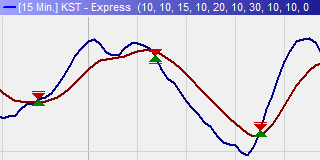

The Trendscore strategy

The HLHB Forex Trend-Catcher strategy

A simple yet effective forex trading strategy from Babypips.

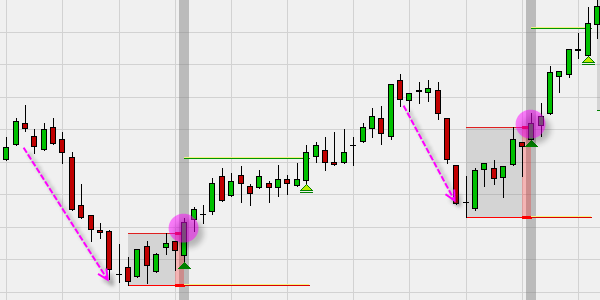

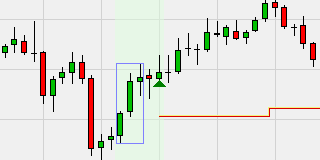

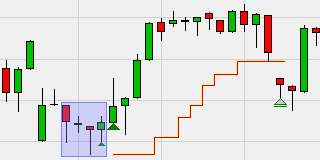

The Inside Bar Momentum strategy

A forex day trading strategy based on a candlestick pattern.

The gold dumper strategy

A day trading strategy that depends on daily drops in the gold price.

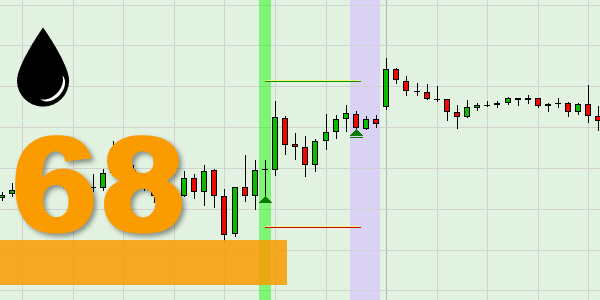

Weekend Oil

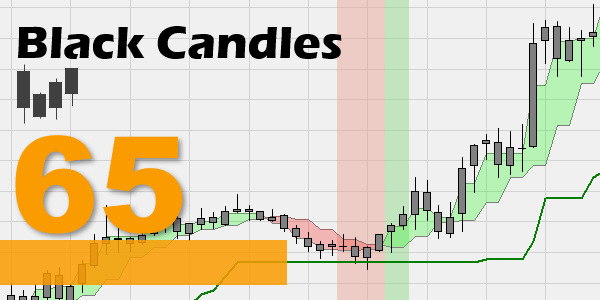

Twenty Entry & Three Exit

A simple yet elegant strategy which every trader is capable of implementing.

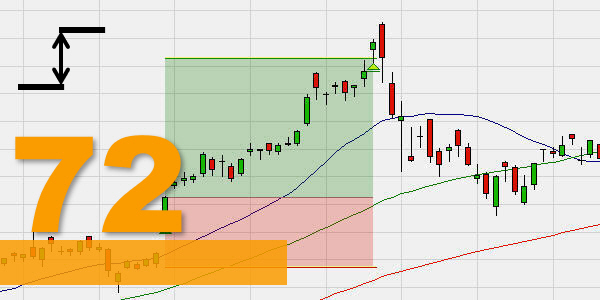

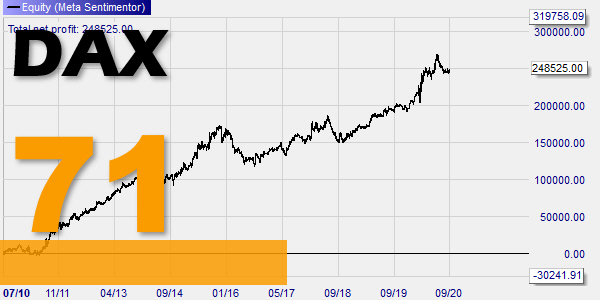

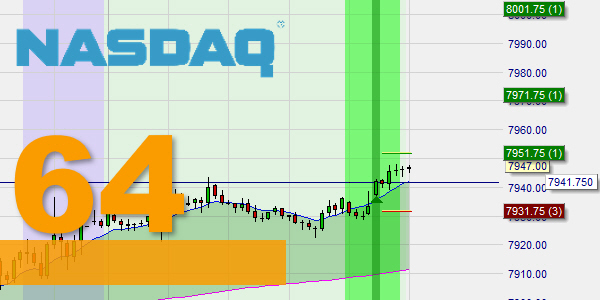

NLO (Nasdaq long only)

A Nasdaq strategy which focuses only on buy signals during bullish market days.

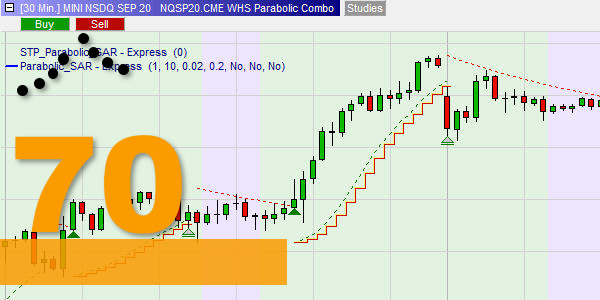

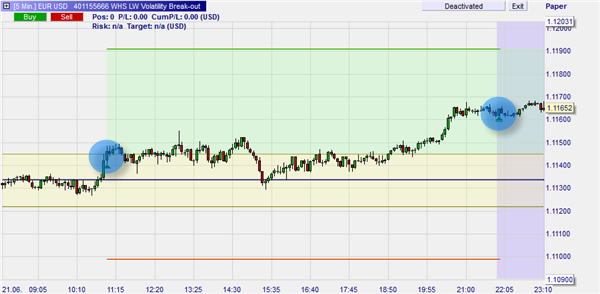

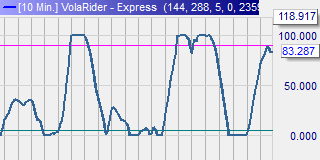

L.W. Volatility Break-Out

The Volatility Break-out strategy was developed by Larry Williams, a U.S. trader-author.

Commodities Forecast

Commodities Forecast is a swing trading strategy used to trade commodities.

Break-out Big Candle

A day trading strategy based on variations in volatility and big candles.

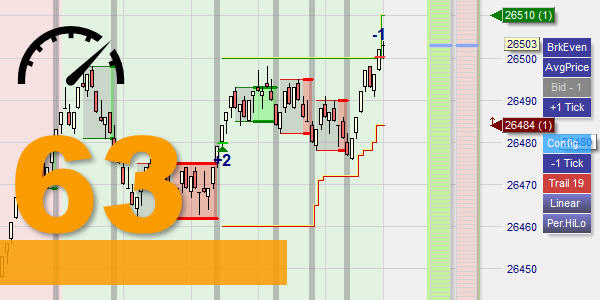

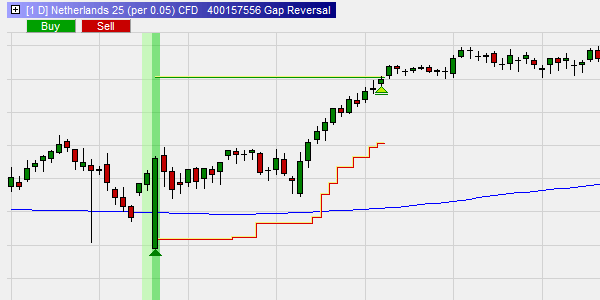

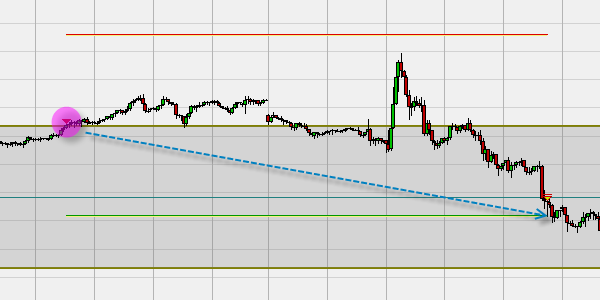

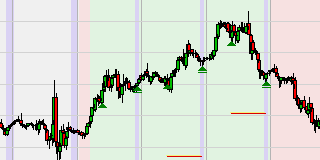

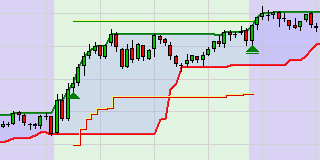

Range Projection

A swing trading strategy for stocks based on trend reversal.

EUR/USD 07h30 - 22h30

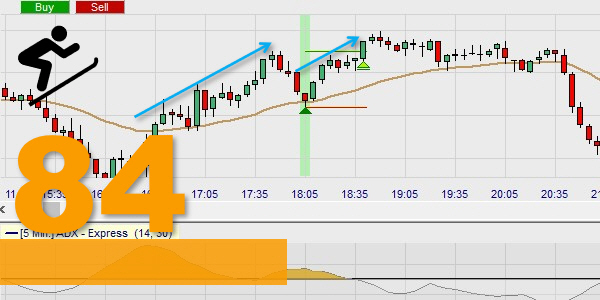

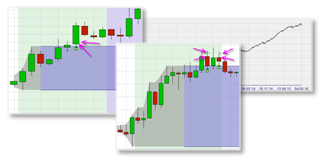

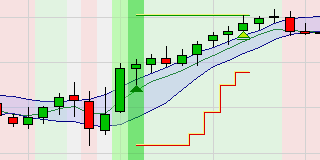

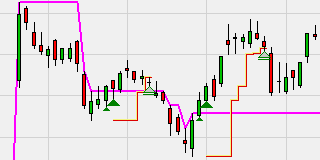

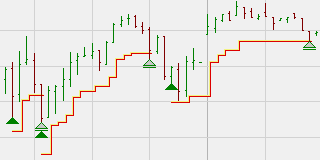

SiWorks Automated Trendline

A day trading strategy based on trendlines. The trendlines are automatically (re)drawn.

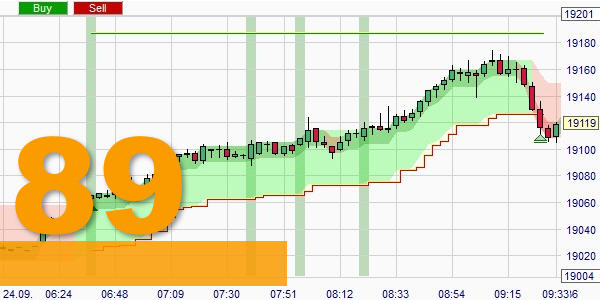

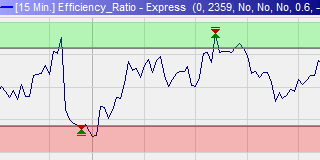

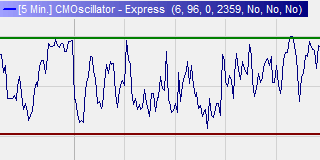

Kaufman Efficiency Ratio

A day and swing trading strategy which identifies, isolates and follows the market trend.

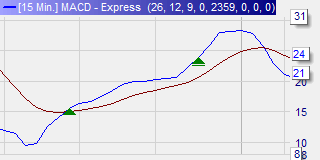

LS Histogram Scalper

An exciting 3-minute strategy based on the groundbreaking LiveStatistics.

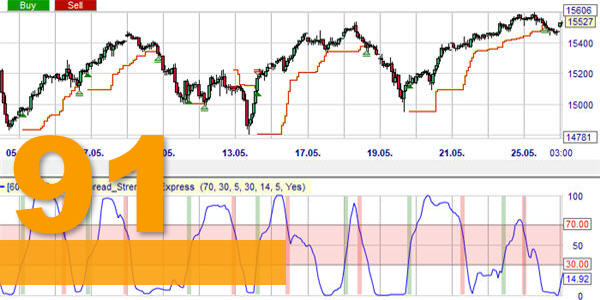

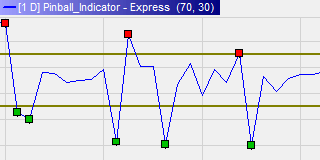

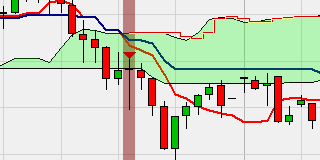

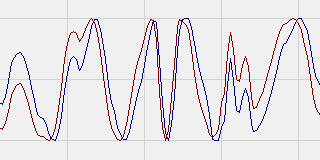

Sinewave Market Cycles

Engineer Dr. John Ehlers has a done a lot of research into market cycles.

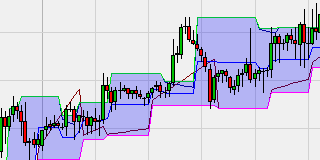

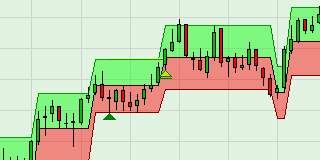

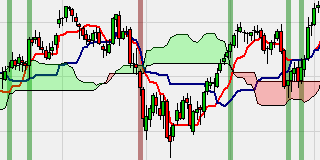

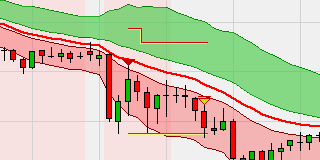

Center of Gravity - Belkhayate

The COG strategy opines that market prices evolve around a center of gravity.

Tip

These strategies are supplied for educational purposes. Do not apply them blindly. Read all information carefully. Discover a strategy slowly and carefully. Adapt the strategies to your situation and skills. Be prudent at all times and make no use or only limited use of leverage.

More trading strategies can be found in the trading store.

You may also be interested in these trading signals.

What is the difference between a trading signal and a trading strategy?

A signal is a combination of criteria which lead to the opening of a position. The trader can then decide how he manages the open position. A trading strategy contains in addition rules regarding the acceptance or rejection of signals and rules on how an open position is managed (stop loss orders, target orders, closing times...).

How do I implement a trading strategy?

Open the chart of the instrument you want to trade (DAX, DOW, stocks, oil...). Activate the trading strategy of your choice by selecting it in the WHS Strategies folder. For semi-automated trading you need to activate TradeGuard + AutoOrder in the chart. For automated trading you need to activate AutoOrder.

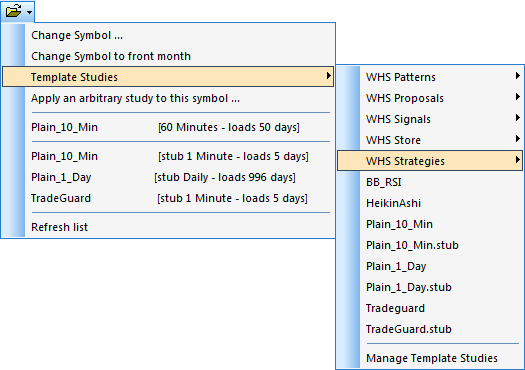

Where do I find the trading strategies in the NanoTrader?

In the NanoTrader you can find the trading strategies in the WHS Strategies folder.