Trading signals

- All trading signals are available in the NanoTrader Full trading platform.

- Six trading signals are available in the NanoTrader Free platform.

- You can set up your own signals. Programming is not required.

- All trading signals can be automated.

- Several of the signals also serve as components in a trading strategy.

Elder Ray Index

An apparently strong trading signal from the very well-known and experienced trader, Dr Alexander Elder.

Bollinger Volatility Explosion

John Bollinger states that an "explosion" in volatility offers an opportunity for traders.

Market Structure Points

Key market turning points, often used to teach beginners how to trade.

Impulse System

Points in time when the market trend accelerates or slows down – Alexander Elder.

MACD Divergence

Opportunities occur when the market price and the MACD diverge – Eric Lefort.

Candlestick Patterns v.1

Define your own candlestick patterns and see how efficient they are.

Candlestick Patterns v.2

Define more complex candlestick patterns or combinations of patterns.

Heikin Ashi Trend Reversals

Define intraday reversal patterns based on the excellent Heikin Ashi candles.

Information

What is the difference between a trading signal and a trading strategy?

A signal is a combination of criteria which lead to the opening of a position. The trader can then decide how he manages the open position. A trading strategy contains in addition rules regarding the acceptance or rejection of signals and rules on how an open position is managed. Many of the trading signals are also available as a component of a trading strategy.

How do I implement a trading signal?

If you just want a notification when a signal occurs and open your position manually, activate a pop-up message, a sound alarm and/or an e-mail. You can do this directly in the chart. If you want to automate the opening of a position the most simple solution is to use Tactic orders.

| Implementing a signal | Opening positions | Closing positions |

| Video | manual | automatic |

| Tactic orders Video 1 & Video 2 | automatic, one time only | automatic |

| Video | automatic | automatic |

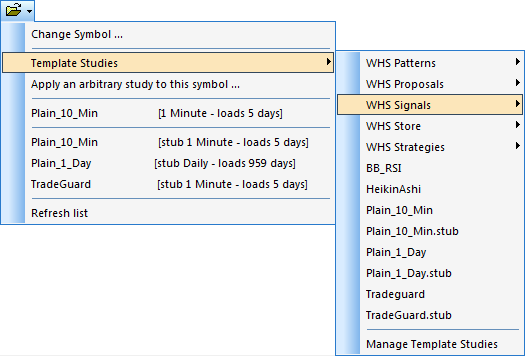

Where do I find the trading signals in the NanoTrader?

In the NanoTrader you can find the trading signals in the WHS Signals folder: